Please wait while we load the content

Empowering traders through cutting-edge education and premium broker partnerships. Join thousands of successful traders worldwide.

© 2025 Bloomvest. All rights reserved. Empowering traders worldwide.

Made by BirthGiver .

© 2025 Bloomvest. All rights reserved. Empowering traders worldwide.

Made by BirthGiver .

Blogs

trend-range-chop

4 minutes

Trend, Range, and Chop — Where Each Approach Fails

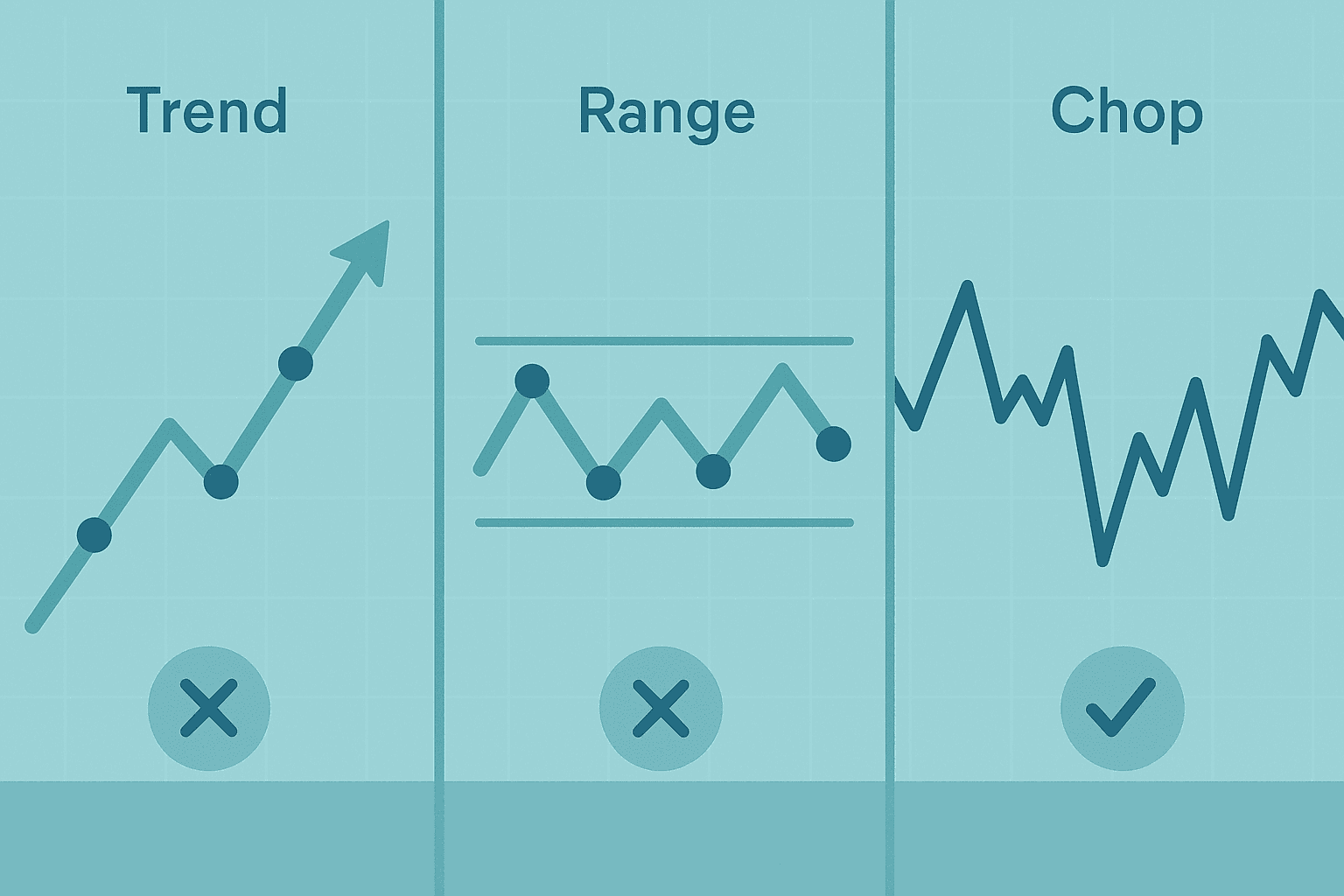

A lot of traders say, “My strategy doesn’t work.” But many times, the strategy isn’t the real problem. The problem is using the right tool in the wrong market condition. Markets usually fall into three broad states: trend, range, and chop (messy, low-quality movement). If you can recognize these states, you can avoid many losses before they happen.

1) Trending Market A trend means price is moving mostly in one direction, and pullbacks are usually smaller than the main move. The simple beginner sign is that highs and lows keep shifting in one direction.

A common mistake in trends is trying to catch reversals just because price has moved “too far.” Markets can stay strong longer than you expect. Many beginners want to catch the exact top or bottom because it feels smart, but it’s often riskier than simply trading in the direction of the trend.

2) Ranging Market A range means price is bouncing between a clear high and low area. The simple sign is repeated reactions from the same upper and lower boundaries.

In ranges, fake breakouts are common. Price may push above resistance or below support briefly, trigger traders, and then snap back into the range. A typical beginner mistake is treating every small breakout as “the real one” and chasing it with emotion. That often leads to repeated stop losses.

3) Choppy Market (Chop) Chop is the worst condition for most traders. It’s not a clean trend and not a clean range. Candles look messy, moves are short, and signals fail often. It feels like the market is “random,” because it kind of is at least from a practical trading perspective.

In chop, the best decision is often not trading. If you do trade, you need to be extremely selective and only take the clearest setups. Trading in chop is like driving in fog: you can move forward, but the chance of a mistake is much higher.

Quick Summary

Learning to avoid bad market conditions is a major part of becoming consistent. Sometimes the most professional trade is the one you don’t take.